Quarterly report | Q3 | Baltic States

Property

Snapshot

Q3 | 2022

Investment market

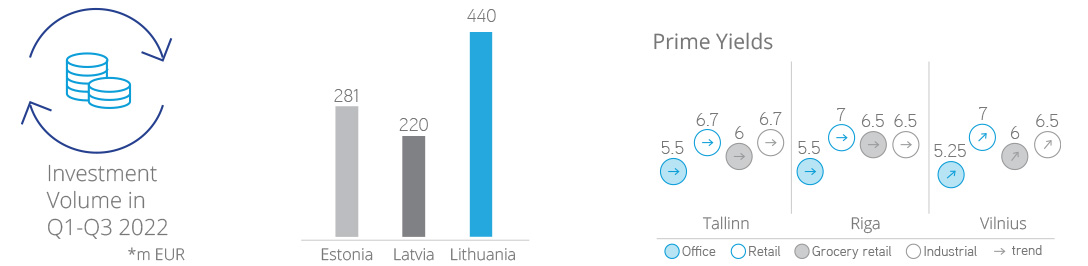

In Q3 2022, the capital market in Estonia continued to show reasonable activity with total investment volume almost reaching EUR 100 million, mainly driven by two large lot-size deals. Titanium acquired Wendre production facility (43,000 sqm; sale-leaseback deal) in Pärnu with the price exceeding EUR 30 million. US Real Estate acquired Foorum Business Centre (Class A office and retail premises with total GLA 9,600 sqm) next to Rotermanni Quarter in Tallinn CBD (the transaction became final after receiving permission from the Competition Authority in October). Notable deals in the office segment also included the sale of the Shnelli Office Building (share deal) in Tallinn. Yields currently still remain unchanged but higher interest rates are starting to suppress investment activity, turning (institutional) buyers to become more cautious and even postpone decision-making until spring 2023.

Key Investment Figures in the Baltic States, Q3 2022

Prime Yields

Estonia

Latvia

Lithuania

Office

5.5%

5.5%

5.25%

Retail

6.7%

7.0%

7.0%

Retail (grocery-led)

6.0%

6.5%

6.0%

Industrial

6.7%

6.5%

6.5%

Source: Colliers

In Q3 2022, investment volume in Latvia reached EUR 45 million, driven by smaller (< 5 mln EUR) transactions. The largest transaction was Eika’s acquisition of retail property on Grostonas St occupied by Maxima, Lemon Gym and Pepco. The second largest deal included the first transaction with stock office in Latvia - Capitalica acquired Marupe Smart Park. In addition, several other grocery-led retail properties were acquired during the quarter. In many recent transactions, the vendor and/ or investor is a private person, indicating that a proportion of owners want to sell as the maintenance costs of properties are growing significantly, while others want to secure themselves against inflation by investing in real estate. Prime yields in Riga currently remain unchanged.

After a very active previous quarter, Q3 2022 was also robust in Lithuania, with total investment volume exceeding EUR 150 million, according to preliminary quarterly data. Demand was dominated by the office segment, followed by industrial and retail properties. One of the biggest deals of the year took place at the end of the quarter – Lords LB European Property Fund, a new fund registered in Luxembourg, acquired the Lvivo office building (share deal) from Lords LB Management, the project developer. The market experienced increased uncertainty about the foreseeable future, forcing some investors to pause but not abandon their plans. On the other hand, we continue to see a willingness among investors to go ahead with acquisitions, as evidenced by larger transactions, so overall market sentiment is not uniform. Compared to the previous quarter, yields in all segments remained stable.

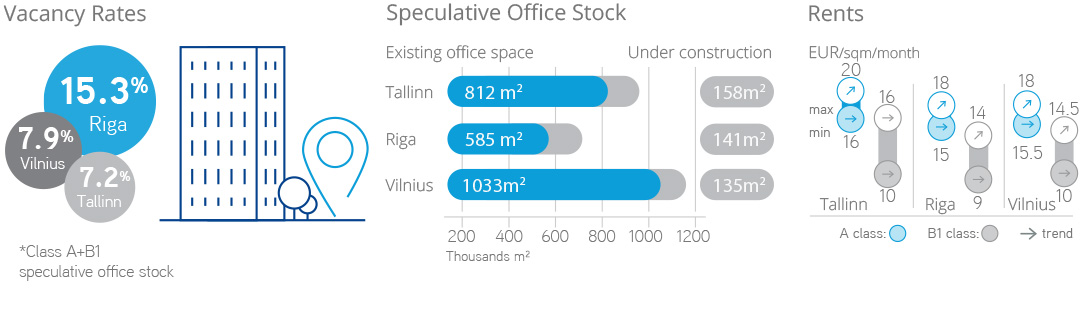

Office market

Development in the Tallinn office market remains constantly active with total GLA exceeding 157,600 sqm (14% of total stock; 17 projects, incl. a new project under way in Telliskivi Quarter) under construction in September and many projects in the completion phase. Demand (continually driven by relocations and expansions in the ICT sector) remained rather calm in the summer months of 2022, while growth in leasing activity and a hike in the number of enquiries is not expected during fall 2022. Total costs related to premises in addition to actual rent are currently a big question mark for both owners and tenants. Tenants are carefully (re)evaluating workspace needs and solutions. Hidden vacancy may start to reshape as physical vacancy (especially at the beginning of 2023), while the number of debtors in the segment will grow.

Key Office Figures in the Baltic States, Q3 2022

Class

Tallinn

Riga

Vilnius

A Class Rents

16-20

15-18

15.5-18

B1 Class Rents

9.9-16

9-14

10-14.5

A Vacancy*, %

5-6%

18-19%

7-8%

B1 Vacancy*, %

7-8%

9-10%

8-9%

Source: Colliers . EUR/sqm/month; *-speculative office market vacancy rate

In Q3 2022, Verde office complex (Class A; stage I) developed by Capitalica entered the Riga market with 78% (one of the best pre-lease ratios for large-scale projects) of space being pre-leased to such companies as Decta, KPMG, Workland, and Swisscom. More than 140,000 sqm of GLA remains under construction, of which approx. 90% will be added to the market next year. Demand is back after a relatively quiet summer; however, the decision-making process has become longer due to the overall situation with construction costs (tenant contribution vs landlord contribution) and increasing and unclear energy costs. Some companies are deciding to remain in their existing buildings for the winter with a hope for more clarity in the market next year. Workplace planning continues to change, with tenants demanding more conference & collaboration rooms and less open space, which in turn impacts office fit-out costs. As asking rent rates in new developments are increasing, the gap between the rental level in newly constructed offices and older stock continues to widen even further.

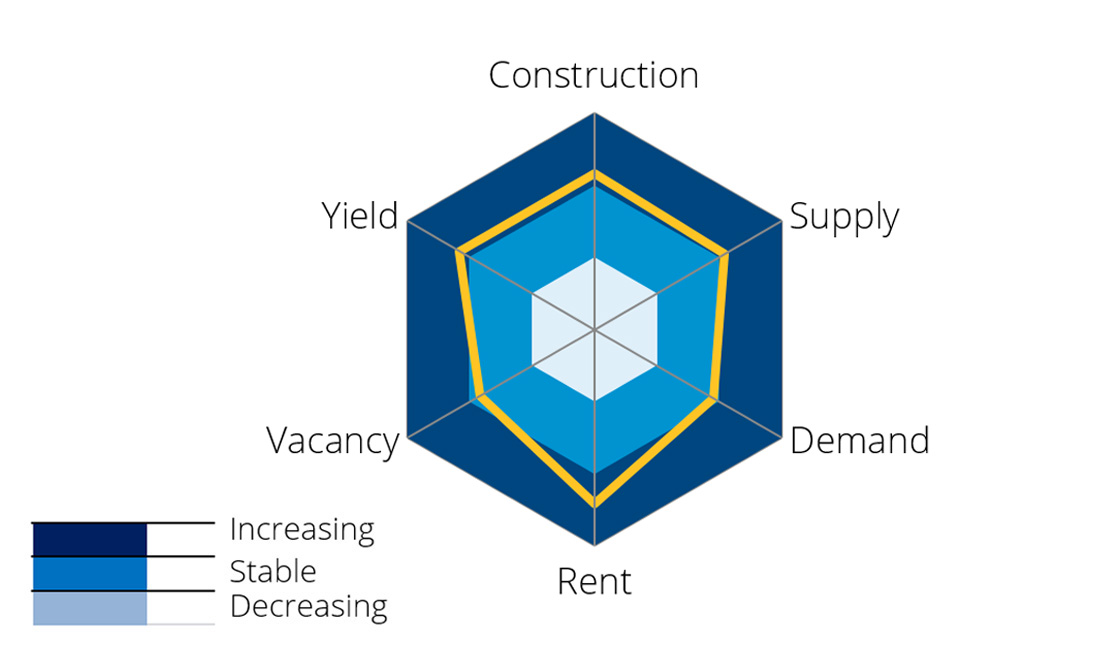

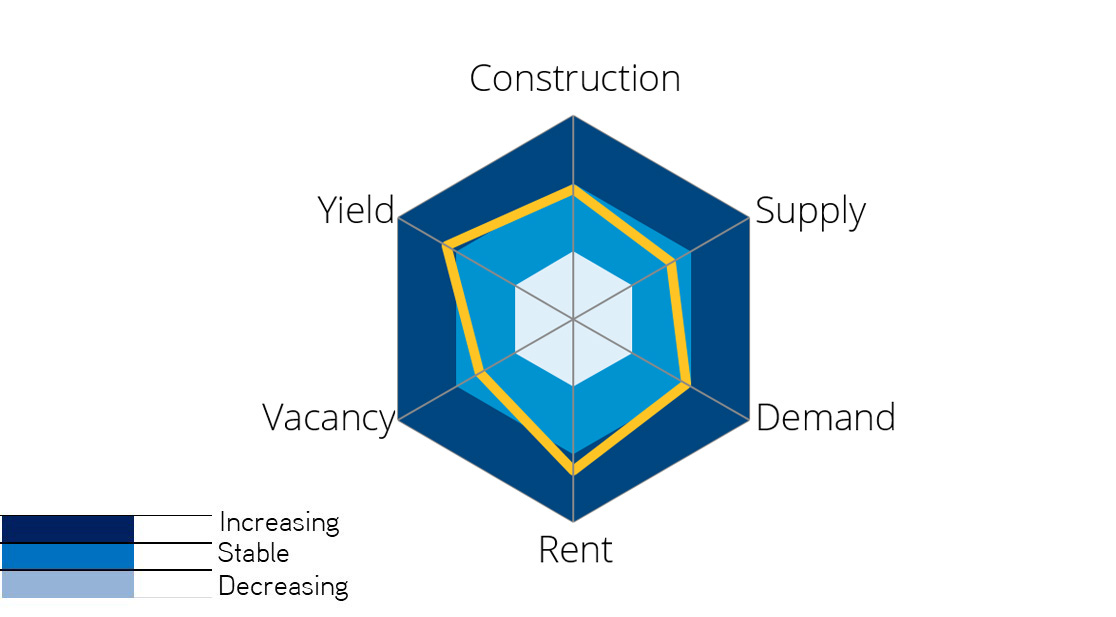

Office Trends

Source Colliers

In Q3 2022, the Vilnius office market recorded completion of three new developments (Class A Core BC and Class B1 Cloud and Meraki BCs), which altogether delivered total GLA of 56,200 sqm. Total stock of speculative office space in Vilnius exceeded the 1 mln sqm level, amounting to 1,033 mln sqm. The development market remained buoyant, with a pipeline of 134,800 sqm under construction at the end of the quarter. The lease market was likewise active, observing take-up of office space in both new and older properties. However, concerns about rising energy prices are driving tenants towards newer and more energy-efficient premises. In Q3 2022, a large lease deal was recorded - a private school rented 4,700 sqm in Lietuvos Draudimas HQ at J. Basanaviciaus St., with planned opening in 2023.

Rent rates stood unchanged compared to Q2 2022.

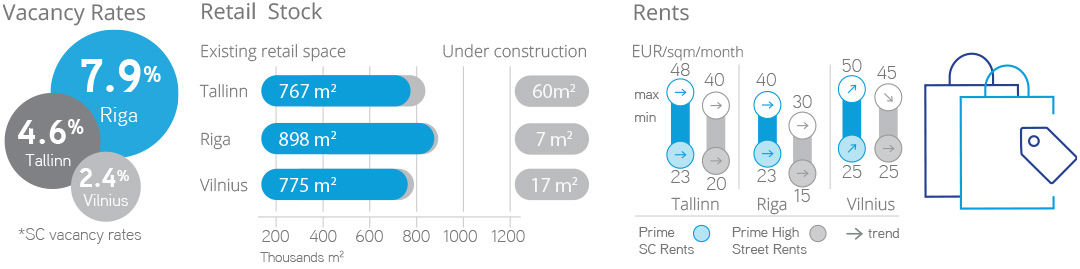

Retail market

This fall, rising energy costs remain one of the key concerns for retail tenants in all three Baltic States. As the winter season is approaching, landlords are starting to implement various countermeasures to keep utility costs at reasonable levels. Among the measures, the most common tactics are lowering centre temperatures from the usual 23 degrees to 18-19 degrees. Other tactics include optimisation of building management systems, diminishing lighting intensity, reducing ventilation capacity, turning off escalators, and ending working hours earlier. Tenants in older retail developments and in street retail are likely to be harmed more by rising utility costs, as these buildings are less energy-efficient and options to control expenditure are limited.

In Estonia, the retail development market continues to show activity, though mainly outside Tallinn city borders. August 2022 saw the opening of the highly anticipated IKEA concept store in Tallinn region (28,000 sqm), which was indeed warmly welcomed by consumers. Summer finally saw the start of construction work on Kurna Retail Park (18,600 sqm; anchor tenants - Decathlon, Selver, Baby City / Toy City, Sportland, Sinsay) next to IKEA store. During 1HY 2022, shopping centre sales

Retail Trends

Source Colliers

and footfall considerably improved by ca one-third compared to 1HY 2021, even growing by up to 70% in several locations (driven by recovery in the hospitality sector and the low reference base). At the same time, inflation, declining purchasing power, rapidly growing utility costs, availability / cost of labour force and hidden vacancy are currently critical issues in the segment, affecting further profitability and thus ability to pay rent.

In Latvia, tenants in the grocery segment continue to remain active. Lidl are proceeding with construction work on multiple new stores, while SPAR opened its first stores in Liepaja and Saldus, along with plans to open up to 200 stores over the next five years. Interest in expansion also appeared in the discount retail and fast-food segments. Vacancy levels showed a slight increase, while rent rates remained stable. Nevertheless, a decrease in rents in the winter season is possible due to high levels of additional costs.

In Vilnius, Q3 2022 saw completion of the second stage of the SC Europa refurbishment project, awarded a BREEAM “In-Use” sustainability certificate by SC Panorama but no new projects started during the quarter. Trends in shopping centres show a slower recovery in footfall, but a faster recovery in sales and per-square-metre turnover, which have already reached pre-COVID levels, influenced by the increase in size of the shopper's basket and high inflation. However, the Consumer Confidence Index is currently at its lowest level since the COVID lockdown in April 2020, and customers are more likely expected to choose discount stores.

Key Retail Figures in the Baltic States, Q3 2022

Tallinn

Riga

Vilnius

Prime SC Rents*

23-45

23-40

25-50

Prime High Street Rents*

25-38

15-30

25-45

Vacancy in SC

4.6%

7.9%

2.4%

Source: Colliers . *EUR/sqm/month; SC – shopping centre

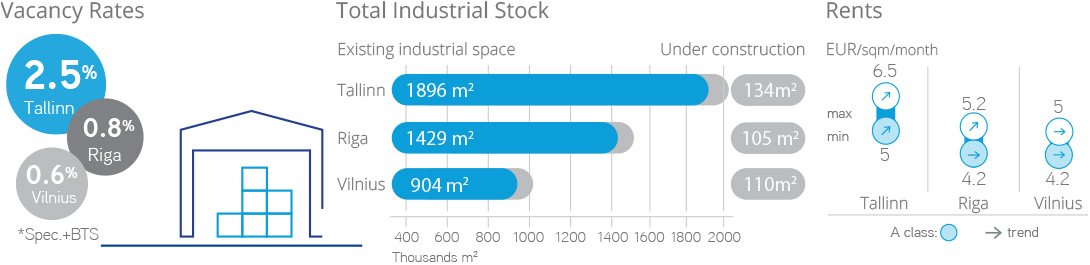

Industrial market

The industrial segment remains active in Tallinn and its suburbs in terms of new developments, with a total area of approx. 133,600 sqm (22 projects) under construction in September. The number and volume of new projects started during the quarter continues to ease as a result of increased construction costs, growing utility costs and overall market uncertainty. Q3 saw completion of 11 stock office projects with total GLA 41,300 sqm, including the R13 Park (7,345 sqm), Rukki tee 2 (8,800 sqm), Reti tee 6, Priisle 18 and Tähesaju 9 stock offices. With at least 50,700 sqm under construction and several new projects launched (e.g., Mäeküla 7 [4,500 sqm] and Kadaka Trade Centre [14,200 sqm; mixed use project] both started by Favorte), developers believe that demand for stock office space will remain rather buoyant. Vacancy continues to trend downwards, decreasing to a historically low 2.5% level by the end of the quarter.

Key Industrial Figures in the Baltic States, Q3 2022

Tallinn

Riga

Vilnius

Prime Rents*

5.0-6.5

4.2-5.2

4.2-5.0

Vacancy

2.5%

0.8%

0.6%

Source: Colliers . *EUR/sqm/month

During the quarter, two major industrial objects – Ulmaņa Parks II and the second part of Rumbula Logistics Park Stage 2 – were completed in Riga region, adding over 33,000 sqm of new warehouse space. Meanwhile, Hepsor finished the active construction phase of the U30 stock office complex with an area of over 3,700 sqm. Q3 saw the start of construction work on only one new project – the second stage of the Mežlīdes stock office complex. Even though the construction process remains stable, developers are hesitant to initiate large-scale developments. Industrial properties are impacted by rising energy costs; moreover, opportunities to reduce energy consumption are limited. New industrial parks are investing in more cost-effective heating solutions, while existing industrial objects are switching from natural gas to LPG to ensure business continuity and lower heating costs in the winter. Leasing activity remains stable, although some tenants are delaying relocation plans until spring. Low supply of new premises has led to a notable decrease in the total vacancy level from 1.6% to 0.8%. Low vacancy has resulted in a hike in prime rent rates to an all-time high level from 5.0 to 5.2 EUR per sqm.

In Q3 2022, the Vilnius warehouse market saw an increase in supply, recording completion of the Vilpra Logistics LC (stage II). The construction pipeline increased to 110,000 sqm at the end of the quarter with construction work started on Lidl LC (GBA 62.300 sqm). Demand has slightly slowed down, but there is still an imbalance between supply and demand, driven by lack of vacant space. The vacancy rate remains low at 0.6%, while rent rates remain stable. Increased energy costs are not yet evident as they are only expected but not actually incurred. However, the approaching heating season is encouraging tenants to start thinking about more energy-efficient warehouses. Although construction prices are stabilising, they still remain high, affecting further development of the I&L market.

Industrial Trends

Source Colliers

Trends for 2022

- Energy costs are currently an issue of concern in all segments.

- Becoming more energy efficient is and will be of the utmost importance.

- Landlords are actively looking for options to improve the energy efficiency of their existing and planned developments in order to reduce costs for their tenants.

- Although landlords will continue to implement various countermeasures to keep utility costs at reasonable levels, availability of options to control expenditure remains limited.

- Some current development will be delayed because of increased costs and overall uncertainty.

- Developers are hesitant to initiate new large-scale development projects.

- A longer construction period for office buildings (ca 22-24 month instead of 12-15 months previously) is needed.

- Lack and/or limited number of new projects under way in all sectors might lead to a shortage of new space and a demand/supply imbalance in the upcoming years.

- Refurbishment of existing office buildings is expected to become increasingly popular.

- Refurbishment, expansion, improvement and diversification of the tenant mix will remain on the main agenda for SC landlords and retail investors.

- The retail segment shows a continual shortage of potential tenants and lack of new brand names.

- Due to decreasing profitability, some retailers are being forced to break lease agreements and close non-profitable stores, a trend expected to gradually continue.

- The industrial market is expected to continue to enjoy a low vacancy level, driven by limited new supply and buoyant demand.

- Interest remains strong in investing in cash-flow objects during a high-inflation period.

- Higher interest rates are expected to place upward pressure on yields and suppress investment activity for the rest of the year.

Contact

Maksim Golovko

Research & Forecasting | Estonia

Colliers International Advisors

Estonia Office

+372 6160 777

Toms Andersons

Research & Forecasting | Latvia

Colliers International Advisors

Latvia Office

+371 67783333

Denis Chetverikov

Research & Forecasting | Lithuania

denis.chetverikov@colliers.com

Colliers International Advisors

Lithuania Office

+370 5 2491212

colliers.lithuania@colliers.com

© 2022 :: Colliers International